Enterprise Weekly #452: VCJ Rising Star, The State of Funding, and More

Welcome back! We’re kicking off the year with exciting news that our data, developer tool, and cloud-native infrastructure expert Priyanka Somrah was named to the Venture Capital Journal's 2024 Rising Stars list 🌟 If you’re a building in those spaces, subscribe to her Data Source Newsletter!

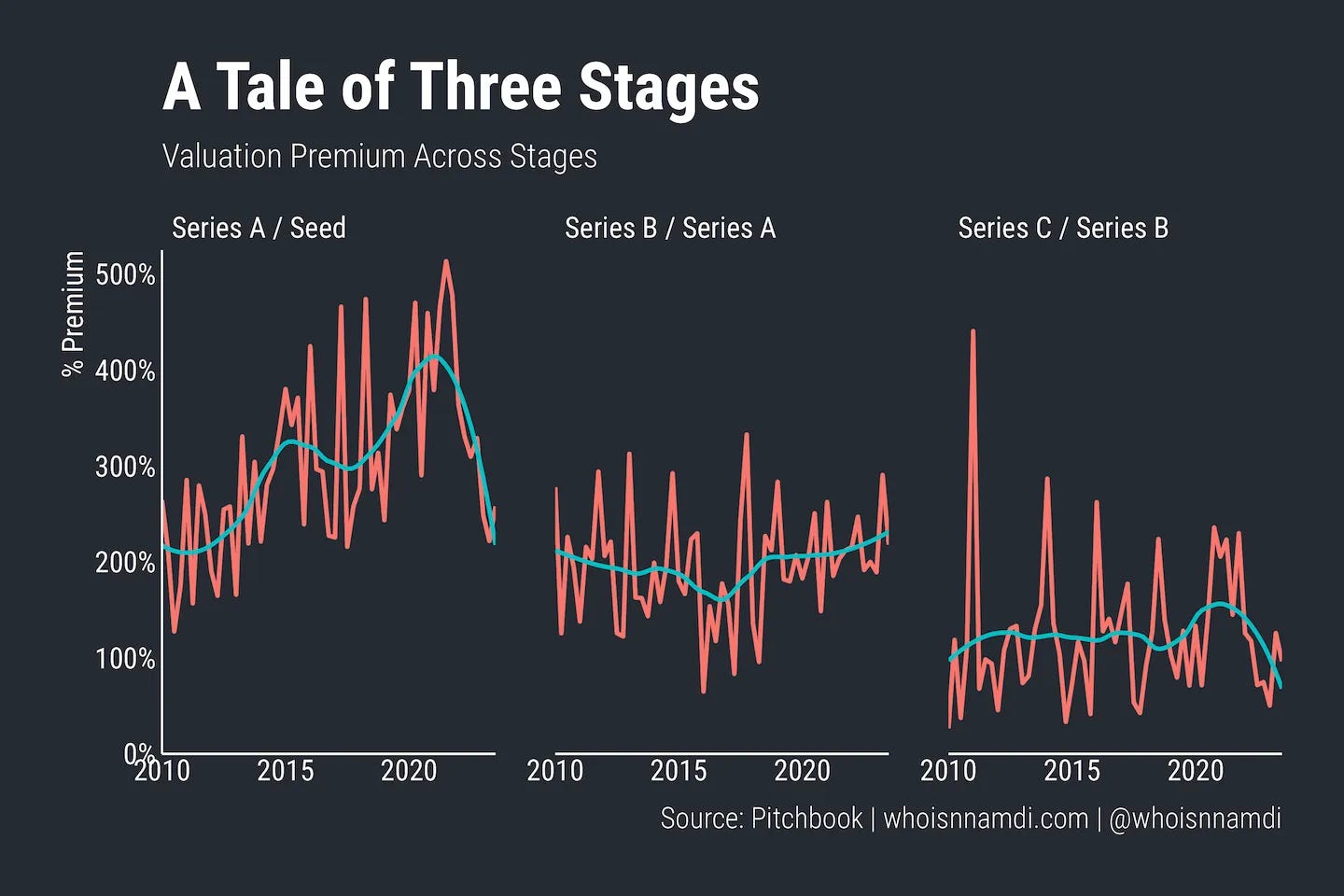

Carta just released their State of Private Markets Q4’23 report, showing valuations across every stage (except Series C) saw slight increases from the prior quarter, but are still way off from Q1’22’s all-time highs:

Seed median pre-money valuation: $14M

Seed median round size: $3M

Series A median pre-money valuation: $45M

Series A median round size: $9M

Series B median pre-money valuation: $103M

Series B median round size: $16M

Looking at valuation step-ups between rounds, we can see that the premium investors are willing to pay at the Series A have fallen off a cliff (see the Series A / Seed chart below). The many companies who raised highly valued Seed rounds during the 2021/22 hype cycle made it difficult for downstream investors to underwrite new priced rounds at higher valuations, causing this decline.

Unfortunately, we believe the frosty funding environment will continue this year as many startups will fall short of the required growth metrics to reach the next stage and support their lofty valuations. The collapse at the Series A has caused investors to wonder if this will create two polarizing opportunities – Seed and growth, with no room for muddy waters at the Series A.

As a reminder, we're still out here leading Seed deals, revving our founders' GTM engine, and helping them find the right Series A partners. If you’re a founder building an early-stage enterprise software startup, we’d love to meet - reach out to chat.

For founders who are looking to cross the Seed to Series A chasm, there is only one way through - and that is to build great products that solve significant business problems. Keep at it, and wishing everyone all the best for 2024 💪

📚 Roundup of predictions:

Fortune on AI predictions

TechCrunch on 40 investor predictions

TechCrunch on VCs predict more exits

📚 Read more (th)reads:

Company: Alkymi

Role: Senior Data Solutions Architect

Technology: Data Extraction & Document Automation

Funding: $26M from Intel Capital, Canaan Partners and Work-Bench

🌟 Company of the Week 🌟

UltiHash raises $2.5M led by Inventure

Data / AI / Machine Learning • Pre-Seed • San Francisco, CA

Founder: Tom Lüdersdorf (CEO)

Magic Feedback raises $1.3M led by Maki VC

Future of Work • Pre-Seed • Copenhagen, Denmark

Intrinsic raises $3.1M led by Urban Innovation Fund, Y Combinator and Others

Risk / Security • Seed • San Francisco, CA

Giga ML raises ~$3.7M led by Nexus Venture Partners, Liquid 2 Ventures and Others

Data / AI / Machine Learning • Seed • San Francisco, CA

Arcane raises $5M led by Accel

Sales / Marketing • Seed • London, England

Turngate raises $5M led by Paladin Capital Group

Risk / Security • Seed • Ellicott City, MD

Salvador Technologies raises $6M led by Pico Venture Partners

Risk / Security • Seed • Tel Aviv, Israel

Strike Graph raises $8.5M led by BAMCAP

Risk / Security • Venture • Seattle, WA

Distributional raises $11M led by Andreessen Horowitz

Data / AI / Machine Learning • Seed • San Francisco, CA

ScaleOps raises $21.5M led by Lightspeed Venture Partners, NFX and Glilot Capital Partners

Infrastructure / Dev Tools • Series A • Tel Aviv, Israel

Robin AI raises $26M led by Temasek

Data / AI / Machine Learning • Series B • London, UK

Link11 raises $29.2M led by Pride Capital Partners

Risk / Security • Private Equity • Frankfurt, Germany

Halcyon raises $40M led by Bain Capital Ventures

Risk / Security • Series B • Austin, TX

SimSpace raises $45M led by L2 Point Management

Risk / Security • Venture • Boston, MA

Aqua Security raises $60M led by Evolution Equity Partners

Risk / Security • Series E • Boston, MA

Perplexity raises $70M led by IVP

Data / AI / Machine Learning • Venture • San Francisco, CA

Harvey raises $80M led by Elad Gil, Kleiner Perkins and Others

Data / AI / Machine Learning • Series B • San Francisco, CA

Lightmatter raises $155M led by GV and Viking Global Investors

Infrastructure / Dev Tools • Series C • Boston, MA

Clearlake Capital Group and Insight Partners acquires Alteryx for $4.4B

Data / AI / Machine Learning • Acquisition • Irvine, CA

Okta acquires Spera Security for $100M+

Risk / Security • Acquisition • Tel Aviv, Israel

Airtable acquires Airplane for an Undisclosed Amount

Infrastructure / Dev Tools • Acquisition • San Francisco, CA

Cisco acquires Isovalent for an Undisclosed Amount

Risk / Security • Acquisition • Cupertino, CA

Salesforce acquires Spiff for an Undisclosed Amount

Sales / Marketing • Acquisition • Sandy, UT

ServiceNow acquires UltimateSuite for an Undisclosed Amount

Future of Work • Acquisition • Prague, Czech Republic

Snowflake acquires Samooha for an Undisclosed Amount

Data / AI / Machine Learning • Acquisition • Los Altos Hills, CA