Enterprise Weekly #491: Get to Know Seed VCs, #Womenterprise AI Panel, and More

Work-Bench is an enterprise software VC firm leading Seed rounds. If you are or know anyone thinking about founding an enterprise software startup — we’d love to meet! Please reach out to chat. 📩

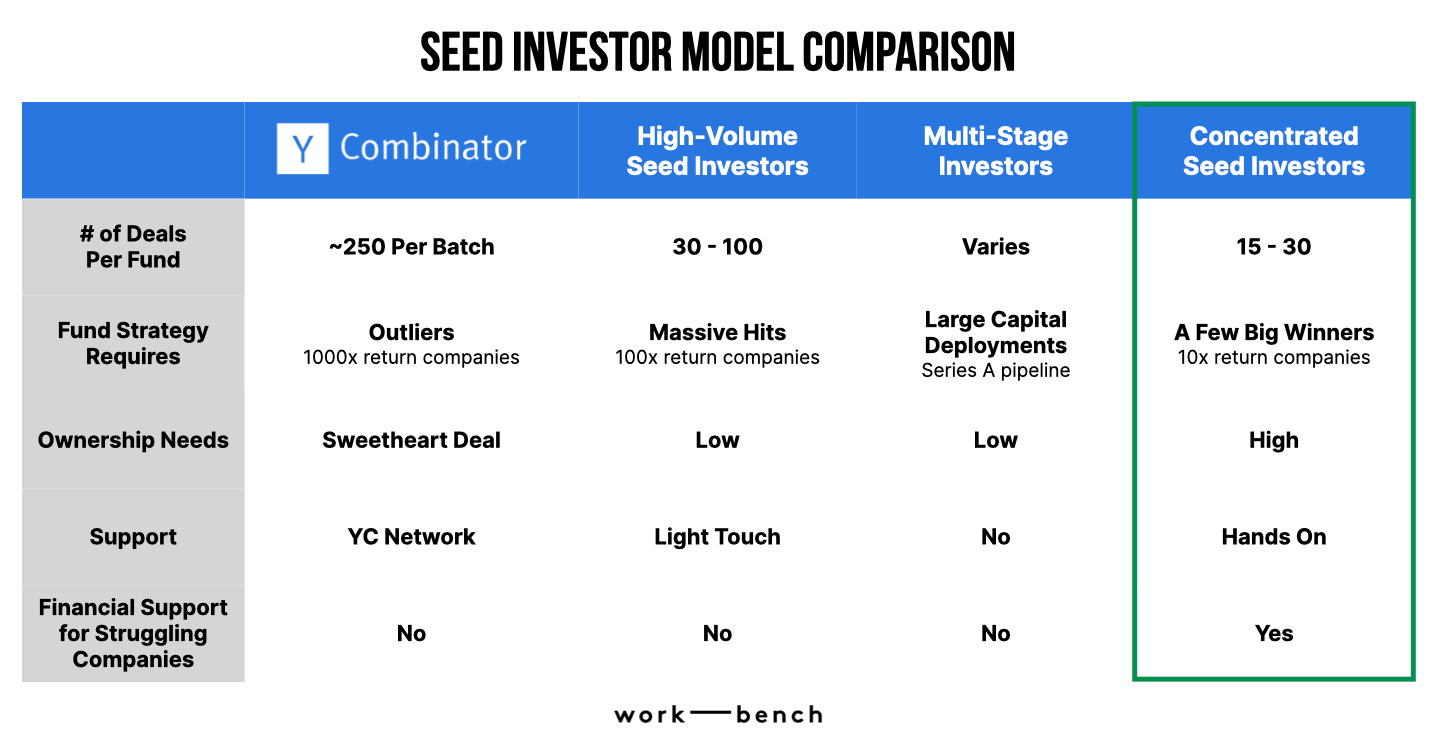

In today’s market, we’re seeing a bigger push for founders to understand the dynamics at play when considering a fundraise. This applies for any stage, but especially at Seed, where founders need the most support in their 0-1 journey to find product-market fit and begin GTM. Whether you’re raising money from a traditional Seed fund or billion dollar megafund, you need to know what you’re signing up for.

While we’ve written about this before, Jamin Ball of Altimeter wrote a recent post on Misaligned Incentives which reinforced several important points, and Jon spoke at length about this topic recently on Rho’s NYC Seed podcast.

The most important and perhaps opaque point that Jamin flags is:

“In the past, the only path to “get rich” for GPs ALSO resulted in a “get rich” path for founders. Today there is a “get rich” path for GPs where the outcome of the founders is irrelevant. Doesn’t matter how the underlying companies in a fund perform, you collect the annual management fees regardless.”

This leads to misaligned behavior in 3 categories:

Raising too much too early

Investments as call options

Number of investments/boards

This aligns well with Jon’s previous post, which he summarized in this chart below:

For concentrated Seed funds like us at Work-Bench, a lot of our value for founders is driven by our hands on support and dedicated focus that multi-stage funds structurally can’t offer.

Next week is jam-packed with events:

➡️ Our Work-Bench #Womenterprise community is more dedicated than ever to bringing women together to connect and learn. Join us next Wednesday, November 13th in NYC for an event with women sales leaders from OpenAI, Runway, and Hebbia who will share their learnings on selling AI-native products in today’s market. Register here and share widely.

➡️ If you’re attending KubeCon in Salt Lake City, be sure to say hello to our portfolio companies, AuthZed (scalable authorization), FireHydrant (alerting and incident management), and Prequel (detection engineering), who will be repping at the conference 👋

🗓️ Join more events:

Nov 13th: Enterprise Masterclass: How To Structure a Post-Sales Process featuring our trusted Sales Advisor Kiran Narsu

Nov 13th: K8s Application Problem Detection Workshop for SRE and DevOps practitioners attending KubeCon - hosted by Prequel

Nov 14th: Leveraging LLMs in AppSec on the intersection of AI and application security - hosted by DryRun Security

Nov 14th: ApertureData Challenge: Build Multimodal AI Applications a contest with a leading AI database while competing for fantastic prizes - hosted by ApertureData

Nov 19th: Future Founders Dinners for those thinking about founding an enterprise startup (or very recently have) and are interested in joining peers navigating the same journey

📚 Read more news:

TechCrunch: Nasdaq CEO Adena Friedman Isn’t Surprised We Haven’t Seen A Resurgence in Startup IPOs Yet

TechCrunch: It’s Election Day, and All The AIs — But One — Are Acting Responsibly

📚 Read more (th)reads:

Shensi Ding on things people don't tell you about being a founder

Krysten Conner on what top AEs do to ace meetings with execs

Company: CloudQuery

Role: Head of IT & Security

Technology: Cloud Assets & Configuration

Funding: $18.5M from Work-Bench, Boldstart, Mango Capital, Haystack, Tiger Global Management

🌟 Company of the Week 🌟

Symbiotic Security raises $3M led by Lerer Hippeau, Factorial Capital and Others

Risk / Security • Pre-Seed • New York, NY

Co-Founders: Jerome Robert (CEO), Edouard Viot (CTO)

Corgea raises $2.5M led by Shorooq Partners

Risk / Security • Seed • San Francisco, CA

Thesys raises $4M led by Together Fund

Data / AI / Machine Learning • Seed • San Francisco, CA

Siit raises $5M led by StageOne Ventures and Seventure Partners

Future of Work • Seed • Paris, France

Embed Security raises $6M led by Paladin Capital Group

Risk / Security • Seed • Milpitas, CA

Plato raises $6.5M led by Cherry Ventures

Future of Work • Pre-Seed • Berlin, Germany

Endeavor raises $7M led by Craft Ventures

Future of Work • Seed • San Francisco, CA

Dash0 raises $9.5M led by Accel

Infrastructure / Dev Tools • Seed • New York, NY

Noma raises $32M led by Glilot Capital Partners

Risk / Security • Series A • Tel Aviv, Israel

Cintoo raises $40.3M led by Partech

Data / AI / Machine Learning • Series B • Biot-Sophia Antipolis, France

Melio raises $150M led by Fiserv

Future of Work • Series E • New York, NY