Enterprise Weekly #501: Capital Expenditure Rising, AI, and More

Work-Bench is an enterprise software VC firm leading Seed rounds. If you are or know anyone thinking about founding an enterprise software startup — we’d love to meet! Please reach out to chat. 📩

It’s Super Bowl weekend hyperscaler earnings week!

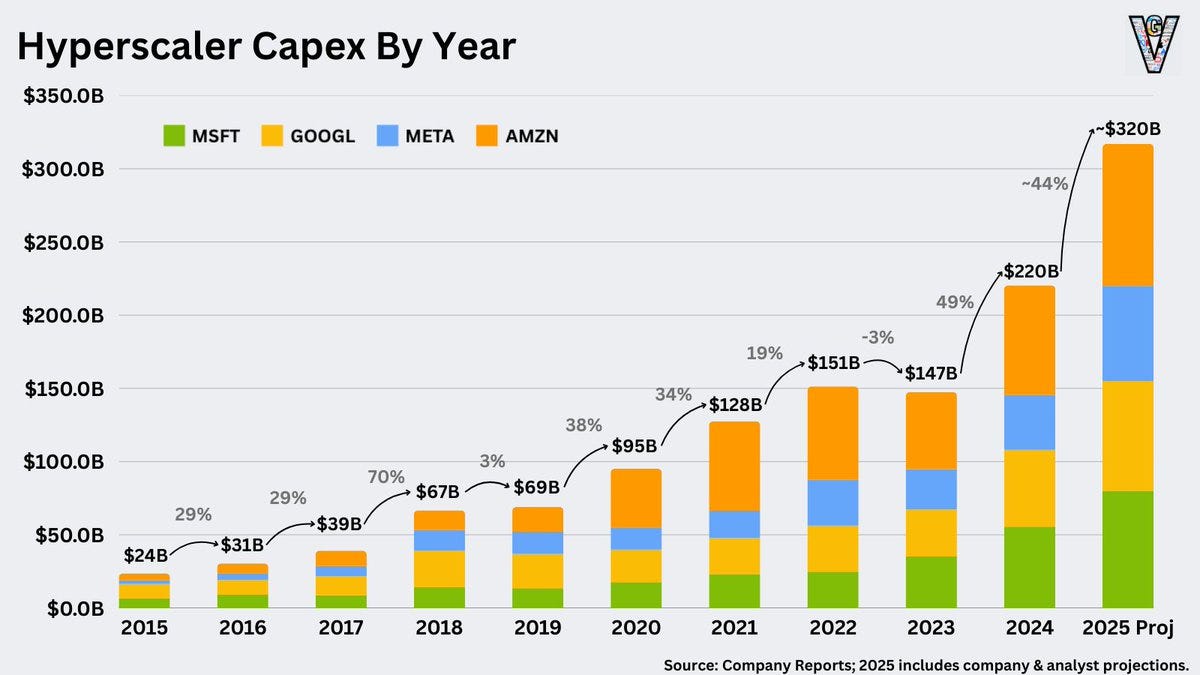

While we’ve historically tracked cloud growth across Microsoft, Google, and Amazon (as it continues to be one of the largest revenue drivers for these companies) this week was all eyes on capital expenditure (CapEx).

All three tech titans (plus Meta) are set to increase CapEx by ~44% in 2025—one of the biggest jumps in a decade, adding ~$100B.

This continued growth in CapEx indicates the AI arms race is still gaining momentum, with much of the money going to AI data centers, despite wide-spread anxiety over the impact of DeepSeek R-1, and whether hyperscalers and AI research labs like OpenAI and Anthropic will sufficiently profit from their unprecedented spending sprees.

What could this mean for the future of AI? More innovation.

Easing of AI Infrastructure Constraints: Investments could start alleviating capacity-constraints in compute, energy, and data centers.

The AI Circle of Life: If supply constraints ease, AI services could become cheaper due to increased infrastructure availability which could lead to more startups and enterprises building with AI.

Acceleration of AI Model Training & Inference: Increased CapEx and production-grade services could mean more GPUs, more custom silicon (AWS Trainium, MSFT Maia, Meta MTIA), and better AI infrastructure—fueling faster training cycles for LLMs and multimodal AI.

Tech giants aren’t slowing down, meaning the race will continue reshaping cloud, semiconductors, and software. Expect even more AI-driven M&A, cloud investments, and enterprise adoption as AI capabilities expand.

2025/26 could be a massive inflection point where AI infrastructure catches up to demand, enabling faster, cheaper, and more powerful AI applications across industries. 🚀

📚 Read more news:

TechCrunch: OpenAI Unveils a New ChatGPT Agent for ‘Deep Research’ and thoughts from Sam Altman

📚 Read more (th)reads:

Company: GovWell

Role: Founding Backend Engineer

Technology: Modern Software For Local Government

Funding: $4.5M from Work-Bench, Bienville Capital

🌟 Company of the Week 🌟

DevAI raises $6M led by Emergence Capital

Infrastructure / Dev Tools • Seed • Palo Alto, CA

Co-Founders: Susie Wee (CEO), Edwin Zhang

Astra Security raises $2.7M led by Emergent Ventures

Risk / Security • Seed • Claymont, DE

GetWhys raises $2.8M led by NEXT Frontier Capital

Sales / Marketing • Seed • Boise, ID

LogicStar raises $3M led by Northzone

Infrastructure / Dev Tools • Pre-Seed • Zurich, Switzerland

Pandektes raises $3M led by People Ventures and Interface Capital

Future of Work • Seed • Copenhagen, Denmark

Invary raises $3.5M led by SineWave Ventures, Hyperlink Ventures, and Others

Risk / Security • Seed • Lawrence, KS

Neuralk-AI raises $4M led by Fly Ventures

Data / AI / Machine Learning • Seed • Paris, France

Perspective AI raises $4M led by Village Global, Array Ventures and Others

Sales / Marketing • Seed • Palo, Alto, CA

Converge raises $5.6M led by Uncorrelated Ventures, and General Catalyst

Sales / Marketing • Seed • New York, NY

Warmly raises $6M led by RTP Global

Sales / Marketing • Series A • San Francisco, CA

Lorikeet raised $9M led by Blackbird

Sales / Marketing • Seed • Sydney, Australia

Desteia raises $8M led by Autotech Ventures, Nazca, and Village Global

Future of Work • Seed • New York, NY

Prior Labs raises $9.4M led by Balderton Capital

Data / AI / Machine Learning • Pre-Seed • Freiburg, Germany

Tana raises $14M led by Tola Capital

Collaboration / Productivity • Series A • Palo Alto, CA

GenLogs raises $14.6M led by Venrock and HOF Capital

Future of Work • Series A • Arlington, VA

Cognida.ai raises $15M led by Nexus Venture Partners

Data / AI / Machine Learning • Series A • Chicago, IL

Ivo raises $16M led by Costanoa Ventures

Future of Work • Series A • San Francisco, CA

Atombeam raises $20M led by StartEngine

Data / AI / Machine Learning • Venture • Moraga, CA

Riot raises $30M led by Left Lane Capital

Risk / Security • Series B • San Francisco, CA

7AI raises $36M led by Greylock Partners, Spark Capital, and CRV

Risk / Security • Seed • Boston, MA

Protex AI raises $36M led by Hedosophia

Future of Work • Series B • Dublin, Ireland

Semgrep raises $100M led by Menlo Ventures

Risk / Security • Series D • San Francisco, CA

Solaris raises $145.2M led by SBI Group and Boerse Stuttgart Group

Future of Work • Series G • Berlin, Germany

Riverwood Capital acquires Quicklizard for $52.5M

Sales / Marketing • Private Equity • Tel Aviv, Israel

Sophos acquires Secureworks for $859M

Risk / Security • Acquisition • Atlanta, GA

Worldpay acquires Ravelin for an Undisclosed Amount

Risk / Security • Acquisition • London, UK

Databricks acquires BladeBridge for an Undisclosed Amount

Data / AI / Machine Learning • Acquisition • New York, NY